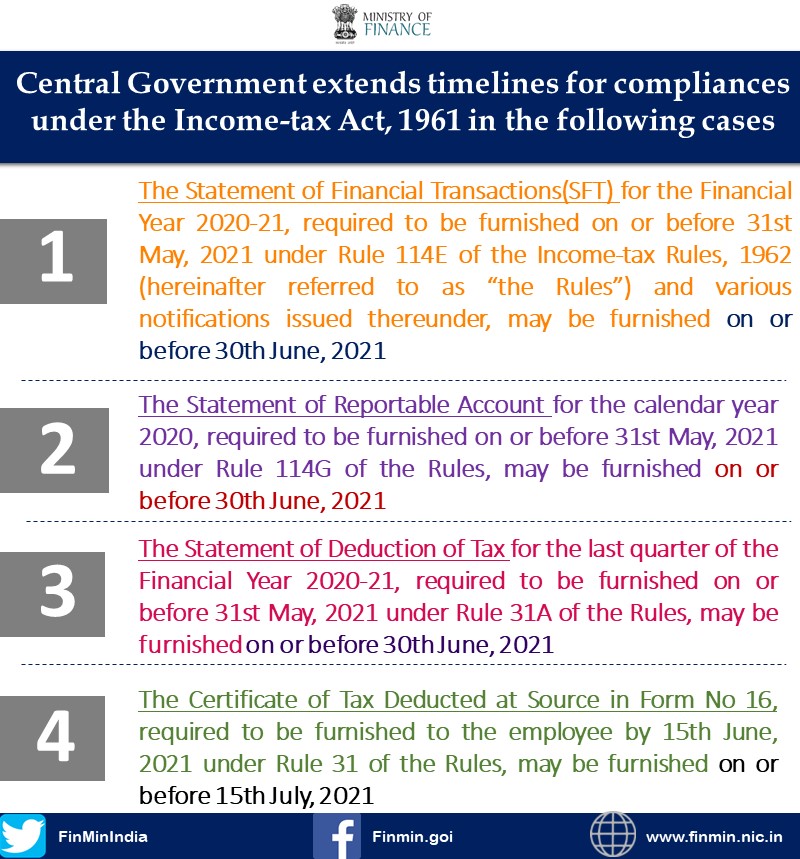

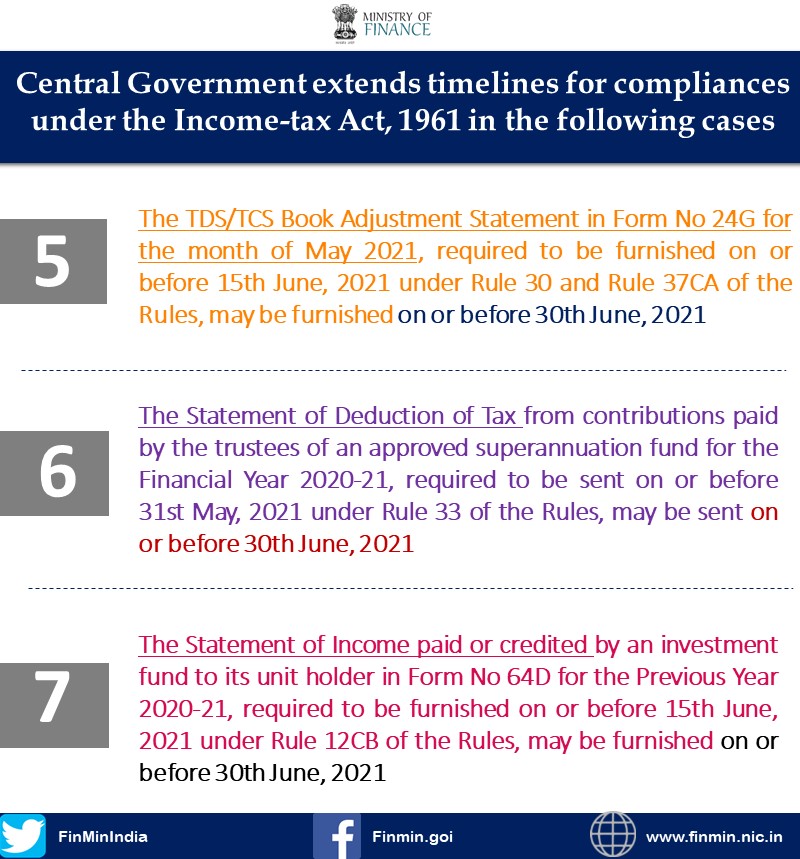

The Income Tax of India Department has extended the various last dates for filing returns for the FY2021 (AY2021-22) including Income Tax Return due to the prevailing 2nd wave of Covid19 Pandemic that has forced the governments of almost every state of India to put lockdown again this year.

According to the press release issued by the Central Board of Direct Taxes (CBDT),

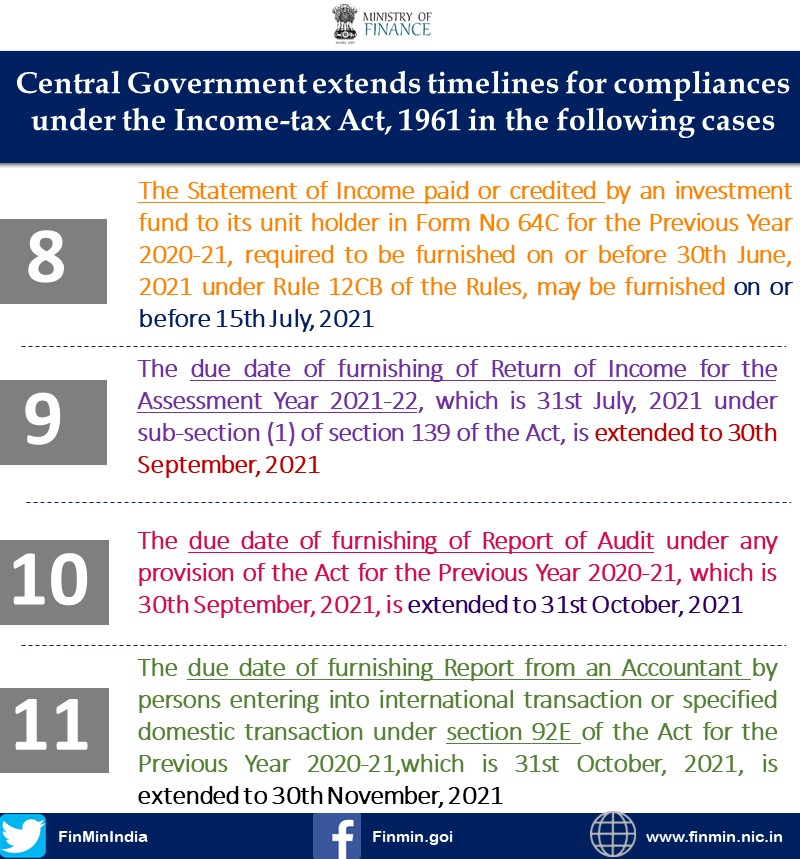

The due date for filing returns for the assessment year 2021-22, which was July 31 earlier, has been extended till September 30. This applies to individual taxpayers whose accounts do not require an audit.

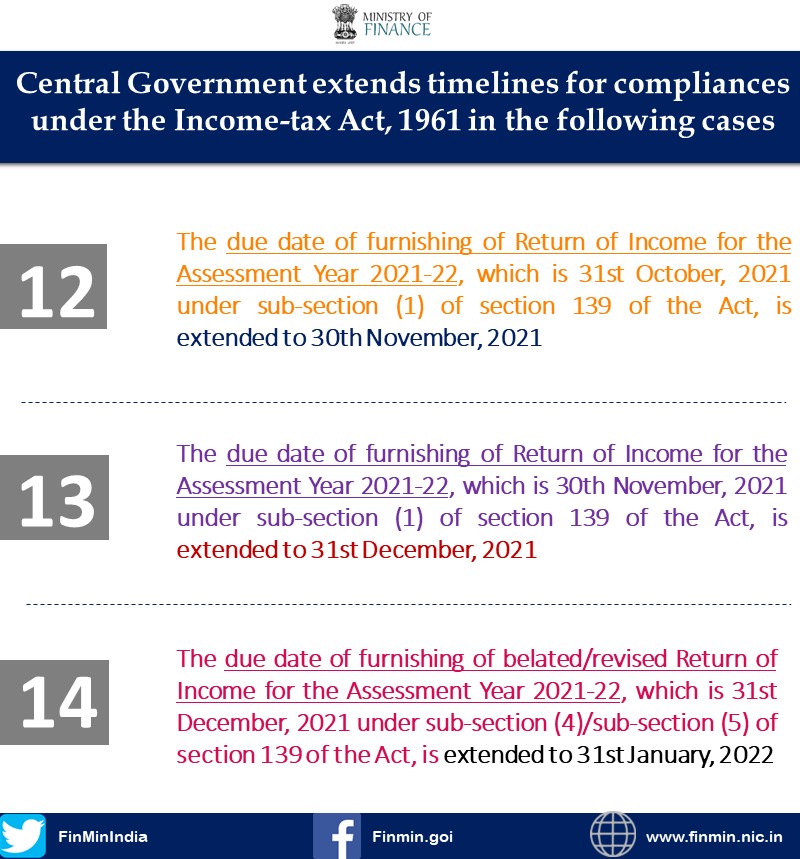

The due date of ITR filing for companies has been extended by a month till November 30 from October 31.

The due date for furnishing the tax audit report has been extended to October 31 from September 30.

Belated or revised returns of income can now be filed by January 31, 2022, from December 31, 2021, according to the statement issued by CBDT.

The last date for issuing Form 16has been extended by a month toJuly 15 from June 15.

Here is the Press Release on extension of certain timelines for compliances under the Income-tax Act, 1961.

Press release may be accessed at:https://t.co/Oyge3Qlu4H pic.twitter.com/Nz9OkNAAuw— Income Tax India (@IncomeTaxIndia) May 20, 2021

Granting major relief to taxpayers facing hardship due to the severe pandemic & in view of representations recd, the Central Govt extends certain timelines for compliances under IT Act. CBDT Circular available on https://t.co/9Q4VYOca0y

Read more➡️ https://t.co/atmjgd4awu pic.twitter.com/eE8a9BtrRH

— Ministry of Finance (@FinMinIndia) May 20, 2021

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

Thank you admin.

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx admin

thx

thx

thx

Thank you admin.

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

Thank you admin.

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

Thank you admin.

thank you

Thank you admin.

Thank you admin.

Thank you admin.

Thank you admin.

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

Thank you admin.

Thank you admin.

thx

thx

thx

thx

thx

Статьи, личный опыт, руководства по преодолению тревоги, развитию критического мышления,

гигиене информации и самопомощи.

Корпоративные программы: Психологическая поддержка сотрудников компаний для улучшения их благополучия.

Философия: Создание поддерживающего

и человечного пространства,

где забота о ментальном здоровье становится нормой

Фокус и эффективность без перегрузок

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thx

thank you

thxx

thxx

thx

thank admin.

thxx

thxx

thxx

thxx

thxx

thx

thxx

thxx

thxx

thxx

thx

thx

thxx

thx

thx

thxx

thx

thxx

thxx

thxx

thxx

thx

thx

thx

thx

thx

thx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thx

thx

thx

thx

thx

thx

thxx

thxx

thxx

thxx

thx

thxx

thx

thx

thx

thx

thx

thx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thx

thx

thx

thx

thx

thx

thx

thxx

thxx

thxx

thxx

а кью тест

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx

thxx