Hey there, finance fans and curious folks! Get ready for an exciting look at the game-changing arrival of Jio Financial Services (JFS) in India’s fintech world. This isn’t just another company launch – it’s a major shift that could change how 1.4 billion Indians handle their money!

The Jio Effect 2.0: From Telecom to Fintech

Remember back in 2016 when Jio shook up the telecom industry with super cheap data plans? Well, they’re back, and this time they’re focusing on your wallet! Let’s break it down:

- Huge User Base: With over 470 million telecom subscribers, JFS starts with a customer base larger than the entire populations of the United States and Canada combined! That’s an incredible starting point in the fintech world.

- Financial Power: Backed by Reliance Industries, India’s largest company (worth about $220 billion), JFS has more cash than most! This financial strength allows them to invest heavily and possibly offer lower prices to attract customers.

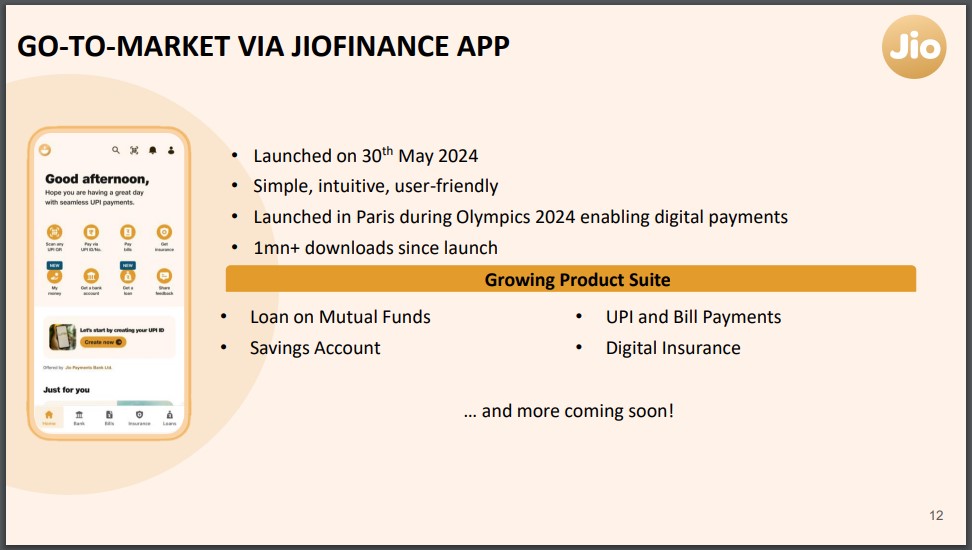

- Tech Skills: Jio’s digital-first approach isn’t just modern – it’s cutting-edge. We’re talking about smart technology that can analyze your credit score, secure transactions, and offer personalized financial products. Traditional banks may feel like they’re stuck in the past!

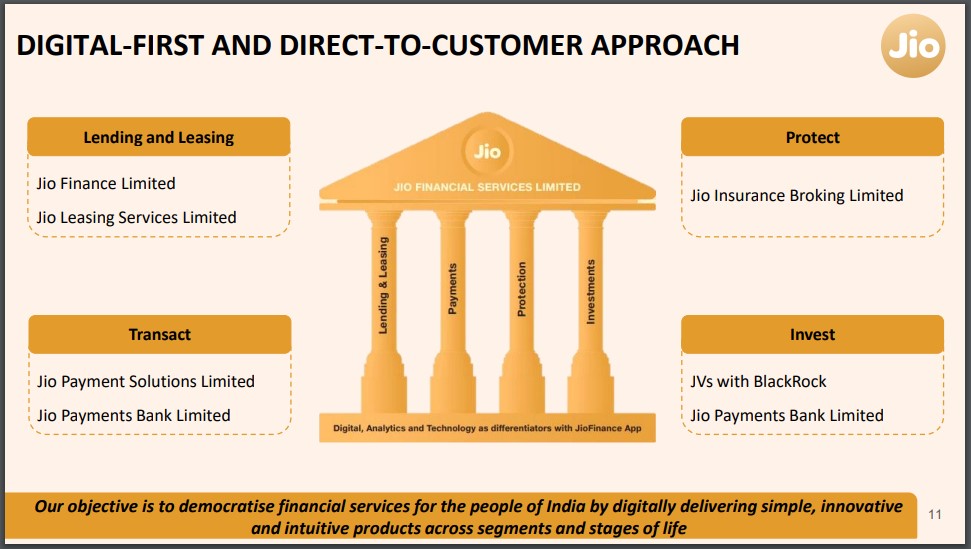

Jio’s Financial Supermarket: What’s on Offer?

JFS isn’t just another fintech startup – it aims to be a complete financial hub:

- Digital Banking: Fully online banking with 24/7 video customer service and quick account opening.

- UPI Payments: Using India’s UPI system, JFS plans to process over 1 billion transactions every month.

- Insurance Services: Offering personalized insurance options for life, health, and general coverage.

- Digital Lending: Quick loans with flexible interest rates based on real-time credit checks.

- Investment Platform: Robo-advisors and easy investing in stocks, mutual funds, and even cryptocurrency.

But here’s the game-changer – Jio’s vast network of over 15,000 retail stores and millions of small business partners creates a unique online-to-offline (O2O) model that no other fintech company in India can match!

Market Disruption: The Ripple Effect

JFS’s entry is like tossing a stone into a pond – the ripples are far-reaching:

- Traditional Banks: The message is clear – adapt or fall behind. Expect banks to invest heavily in technology and possibly team up with fintech companies.

- Example: HDFC Bank has announced a $1 billion plan to upgrade its digital services.

- Fintech Startups: It’s a classic David vs. Goliath situation! Smaller companies will need to find their unique strengths or consider merging to survive.

- Case in Point: BharatPe and PMC Bank’s merger to create a new-age bank.

- Consumers: The real winners! Expect:

- Lower fees: JFS might offer no-fee banking to attract customers.

- Innovative products: Imagine voice-activated loans or virtual financial planning.

- Better customer service: AI chatbots and 24/7 video support could become standard.

Market Analysis: JFS by the Numbers

Let’s look at some numbers:

- Stock Performance: JFS stock is up 3.4% today, beating the Sensex by 4.34%.

- Momentum: It’s on a two-day winning streak with a 4.7% return.

- Monthly Comparison: JFS has jumped 9.06% in the last month, while the Sensex grew by only 2.38%.

Valuation:

- Market Cap: ₹1.64 trillion ($19.8 billion)

- P/E Ratio: 14.2 (lower than the industry average of 18.3, suggesting it may be undervalued)

Financial Projections:

- Revenue: Analysts expect JFS to reach ₹20,000 crore ($2.4 billion) in revenue by FY2025.

- Market Share: Projected to capture 10% of India’s digital payments market by 2026.

Crystal Ball Gazing: What’s Next for Indian Fintech?

- Consolidation Wave: Expect many smaller companies to merge to stay competitive.

- Prediction: At least 3-4 major fintech mergers in the next 18 months.

- Innovation Explosion: The race to stand out will lead to exciting new features.

- Think: Fingerprint payments, smart financial advisors, or even virtual banking experiences.

- Regulatory Changes: With a big player like Jio entering, expect the Reserve Bank of India to introduce new rules for fintech.

- Possible: A new category of “Digital Banks” with special licenses.

- Global Expansion: As the Indian market heats up, expect Indian fintech companies to look for growth opportunities abroad.

- Target Markets: Southeast Asia and Africa could be prime areas for expansion.

The Billion-Rupee Questions

- Can JFS achieve the same success in finance as Jio did in telecom?

- How will traditional banks and established fintech companies respond to this new challenge?

- Will JFS’s arrival help more people access financial services in India’s rural areas?

One thing’s for sure – the Indian fintech scene is about to get more exciting than a blockbuster movie! What do you think? Is JFS the next big disruptor, or just another player in an already crowded market? Let’s discuss in the comments!

Document Source Link: https://www.jfs.in/corporate-announcements/

Aug 30, 2024

Presentation made to the members during the 1st AGM Post Listing of the Company

#JioFinancialServices #FintechRevolution #IndianFinance #DigitalBanking #FinancialInnovation #TechMeetsMoney #BankingDisruption #FinancialInclusion #FutureOfFinance